Gap Insurance 2024: Navigating the Bridge Between Loss and Loan Value

In the ever-evolving landscape of automotive finance, gap insurance remains a critical safeguard for car owners. As we move into 2024, understanding how gap insurance works is more important than ever. This type of insurance serves as a financial safety net, but its nuances can be complex. Let’s break down the essentials of gap insurance in 2024, ensuring you’re well-equipped to navigate its intricacies.

What is Gap Insurance?

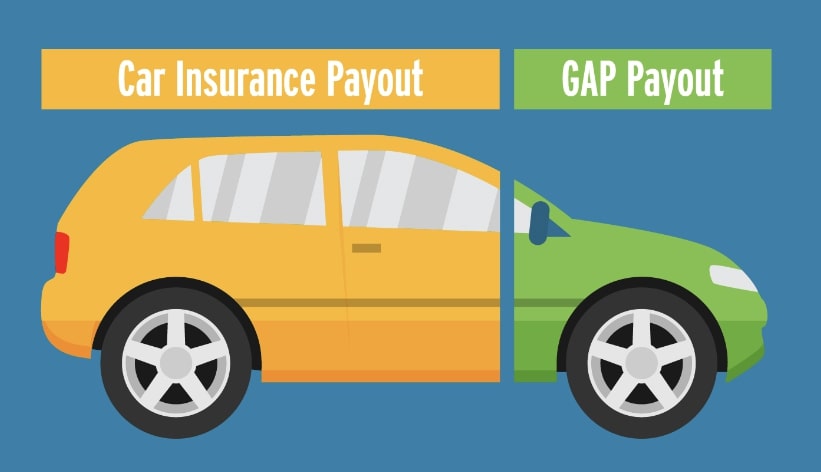

Bridging the Financial Divide: At its core, gap insurance is designed to cover the “gap” between the amount you owe on a vehicle loan or lease and the car’s actual cash value (ACV) at the time of loss, such as in an accident where the vehicle is totaled. This is crucial because depreciation can quickly erode the value of your car, leaving a significant disparity between what your standard auto insurance will pay out and what you still owe to your lender.

The 2024 Landscape

Adapting to New Market Realities: The automotive market in 2024 has seen rapid changes, with electric vehicles (EVs) taking center stage and vehicle prices soaring. These trends have heightened the importance of gap insurance, as higher vehicle values and longer loan terms extend the period during which owners are most vulnerable to the gap.

How Does Gap Insurance Work?

Closing the Gap in Case of Loss: Should you face the unfortunate event of totaling your car, your primary auto insurance policy will pay out the vehicle’s ACV. However, if you owe more on your loan or lease than this amount, gap insurance steps in to cover the difference. This ensures you’re not left paying out of pocket for a vehicle you can no longer use.

The Importance of Gap Insurance in 2024

Evolving with Consumer Needs: With the average loan term extending and the initial depreciation of vehicles remaining steep, gap insurance has become an essential component of financial planning for car owners. It’s particularly relevant for those who:

- Put down a small initial payment on their vehicle

- Have financed their vehicle for 60 months or longer

- Lease their vehicle

- Own vehicles with high depreciation rates, such as luxury cars or certain EVs

Choosing the Right Gap Insurance Policy

Navigating Your Options: In 2024, consumers have more choices than ever for purchasing gap insurance. While dealerships offer gap insurance at the point of sale, exploring options through your auto insurance provider or a standalone gap insurance company can yield more competitive rates and flexible coverage options. It’s crucial to compare policies, taking note of coverage limits, exclusions, and the claims process.

Making an Informed Decision

Assessing Your Needs: Not every car owner will need gap insurance. Evaluating factors such as your loan terms, the rate of vehicle depreciation, and your financial ability to cover a potential gap should guide your decision. Tools and calculators available online in 2024 can help estimate your car’s depreciation and potential gap risk.

Conclusion: Protecting Your Investment

As vehicles become more expensive and loan terms stretch longer, gap insurance solidifies its role as a vital protective measure for car owners in 2024. By understanding how gap insurance works and carefully assessing your need for it, you can ensure that you’re safeguarded against the financial pitfalls that come with vehicle ownership and loans. Remember, the goal of gap insurance is not just to protect your car, but to protect your financial stability and peace of mind in the face of unexpected loss.